Personal Financial Management

Empower your customers with detailed income and spending insights

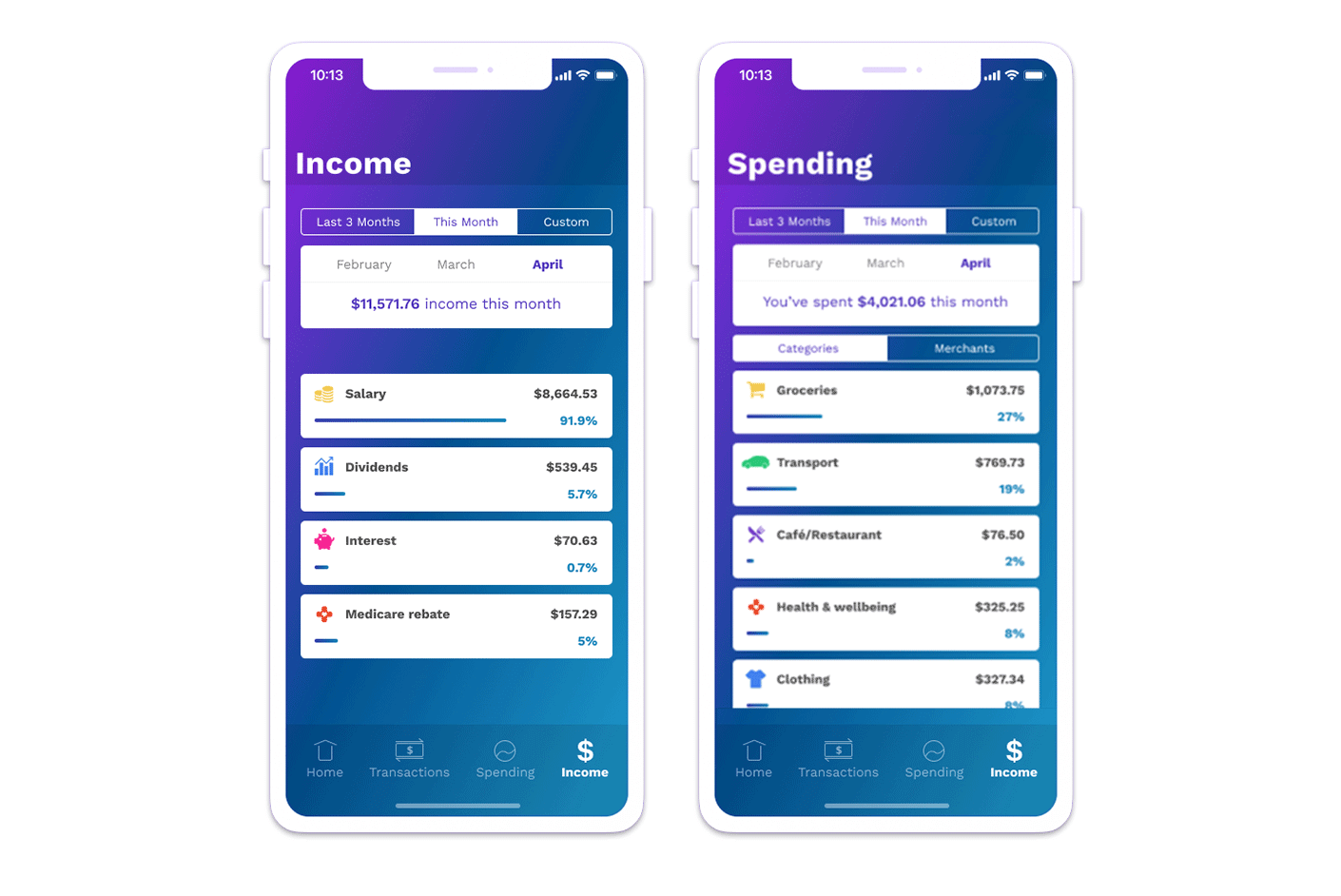

Spending decisions, no matter how small they are, add up and have an impact on everyday finances. Help your customers take more control of their financial health by providing them with a clear view of where their money is going.

Using our super-fast APIs, your customers are able to accurately see what, where and how much they’re earning and spending, in real-time, and with in-depth categorisation.

By integrating accurate and real-time income and expense categorisation into your digital banking experience, you can better support your customers’ budgeting and savings goals.

The category view provides accurate and meaningful spend data with up to 300 customisable categories tailored to consumer spending habits. There are also comprehensive merchant details at a transaction level including logos, trading names, contact details and map view.

The unrivalled comprehensive dataset that we can return on each transaction – up to 100 data points - enables an accurate view of spend not just at a category level, but also at a merchant level.

Provide your customers with an instant overview of their income and expenses in real-time.

A match rate of 98% and up to 100 data points returned on every transaction including trading name, company logo, contact details and more.

Up to 300 customisable categories tailored to consumer spending habits. Customers can also re-categorise transactions.

Easily provide personal financial management tool features to your customers so they can budget and save better as well as track their progress.

An unrivalled comprehensive dataset of over 96 million transactions linked to a database of 1 million merchants.

API driven so the solution can be seamlessly integrated with your existing digital applications.